The next setback in oil prices is looming as the Organization of the Petroleum Exporting Countries and allies meet later this week to discuss output levels for July.

The eight OPEC+ countries, including Saudi Arabia and Russia, with voluntary production cuts will vote on their future production strategy on June 1.

Delegates suggest a continuation of substantial daily oil production increases, potentially reaching 410,000 barrels per day for the third consecutive month, according to Commerzbank AG.

The eight members of the cartel had previously agreed to raise oil production by over 400,000 barrels per day for both May and June.

This had weighed heavily on sentiments in the oil market, with prices slipping below the $60 per barrel at the beginning of May.

Even though prices hover around $60 a barrel, which is far from the desired levels of OPEC+ countries, analysts and experts believe there would be no relief in terms of supply in the coming months.

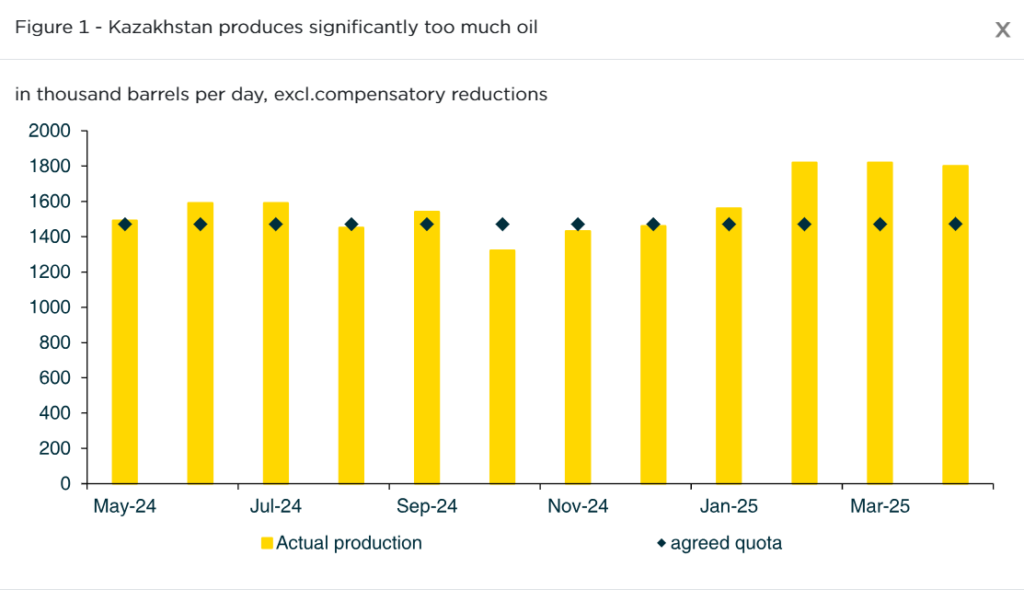

“The fact that Kazakhstan has apparently still not cut back its production (Fig. 1 or see below) speaks in favour of this,” Barbara Lambrecht, commodity analyst at Commerzbank, said in a report.

Individual countries’ failure to meet production targets in the past two months likely led Saudi Arabia to cease its role as the primary supporter of price stability.

Lambrecht said:

This would threaten an even greater supply surplus on the oil market. This is because there are no signs of a revival on the demand side.

Oil demand

China’s crude oil processing remained weak in April, suggesting continued sluggish demand in this key market.

The country is the world’s largest importer of the fuel.

“From next week, the focus will increasingly turn to the country with the highest oil consumption, the US, where the so-called ‘summer driving season’ begins with the Memorial weekend,” Lambrecht said.

The US Energy Information Administration’s latest outlook anticipated that gasoline prices will be 9% lower in the second and third quarters compared to the previous year, which is expected to have a stimulating effect due to these lower prices.

Despite this, the EIA forecasts that gasoline consumption will average approximately 9.1 million barrels daily during the peak demand period, similar to the previous year’s level.

“This means that the oil price will not be boosted from this side either,” Lambrecht said.

Reduced drilling activity

The sustained low oil prices have led to a decrease in drilling operations within the United States.

The number of active drilling rigs in the US decreased by 8 last week, according to Baker Hughes data, reaching 465.

This marks the fourth straight week of decline, bringing the rig count to its lowest level since November 2021.

“The slowdown in activity is no surprise, considering West Texas Intermediate (WTI ) forward prices are averaging a little over $60/bbl for the remainder of this year,” analysts at ING Group, said.

The industry needs, on average, $65 per barrel to drill a new well profitably, according to the Dallas Federal Reserve’s quarterly energy survey.

Geopolitical concerns

“However, the oil market is unlikely to enter calm waters, as geopolitical developments are likely to continue to cause volatility,” Commerzbank’s Lambrecht said.

According to Iranian President Masoud Pezeshkian on Monday, Iran can endure even if nuclear negotiations with the US do not result in an agreement.

The negotiations regarding a nuclear deal between Iran and the US are due to continue.

A potential agreement could raise hopes for easing sanctions against Iran, potentially increasing pressure on oil prices.

Meanwhile, according to analysts at ING, the eight countries in the OPEC+ alliance are likely to go ahead with another increase of 411,000 barrels per day in July.

The analysts at ING added:

This should keep the market well supplied over the second half of this year.

At the time of writing, the WTI crude oil price was at $61.17 per barrel, down 0.6% from the previous close.

The Brent oil price was down 0.5% at $63.80 a barrel.

The post Oil prices under pressure as OPEC+ mulls further supply boost appeared first on Invezz